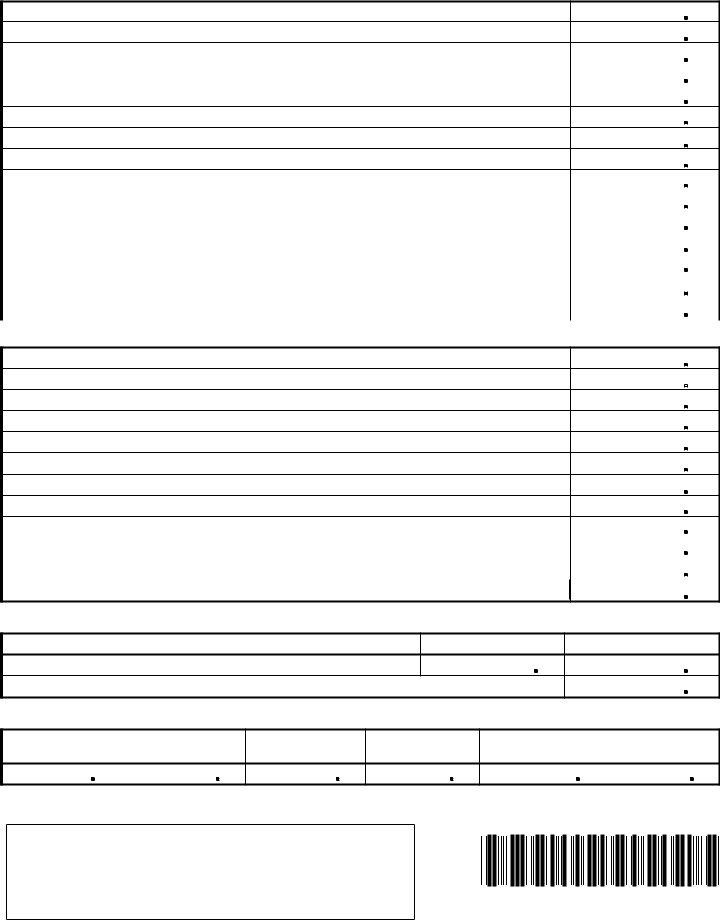

West Virginia Sales And Use Tax Form . — instructions for west virginia sales and use tax return, form wv. Any individual or business that has made retail sales in west virginia or owes use. English deutsch français español português italiano român. — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. — west virginia levies a 6% state sales tax on the retail sale, lease, rental, or license to use tangible personal property and certain services in. west virginia sales and use tax return. Please attach all schedules and supporting documentation. — this blog gives detailed instructions on how to file and pay sales tax in west virginia using the form called the combined sales and use return.

from formspal.com

— instructions for west virginia sales and use tax return, form wv. Please attach all schedules and supporting documentation. — west virginia levies a 6% state sales tax on the retail sale, lease, rental, or license to use tangible personal property and certain services in. English deutsch français español português italiano român. — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. Any individual or business that has made retail sales in west virginia or owes use. — this blog gives detailed instructions on how to file and pay sales tax in west virginia using the form called the combined sales and use return. west virginia sales and use tax return.

Cst 200Cu Form ≡ Fill Out Printable PDF Forms Online

West Virginia Sales And Use Tax Form — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. Please attach all schedules and supporting documentation. — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. west virginia sales and use tax return. — west virginia levies a 6% state sales tax on the retail sale, lease, rental, or license to use tangible personal property and certain services in. Any individual or business that has made retail sales in west virginia or owes use. — this blog gives detailed instructions on how to file and pay sales tax in west virginia using the form called the combined sales and use return. English deutsch français español português italiano român. — instructions for west virginia sales and use tax return, form wv.

From www.templateroller.com

Download Instructions for Form WV/CST200CU West Virginia Sales and Use West Virginia Sales And Use Tax Form Please attach all schedules and supporting documentation. Any individual or business that has made retail sales in west virginia or owes use. — this blog gives detailed instructions on how to file and pay sales tax in west virginia using the form called the combined sales and use return. west virginia sales and use tax return. English deutsch. West Virginia Sales And Use Tax Form.

From www.templateroller.com

Form DMV3L Fill Out, Sign Online and Download Fillable PDF, West West Virginia Sales And Use Tax Form west virginia sales and use tax return. — west virginia levies a 6% state sales tax on the retail sale, lease, rental, or license to use tangible personal property and certain services in. — instructions for west virginia sales and use tax return, form wv. — this blog gives detailed instructions on how to file and. West Virginia Sales And Use Tax Form.

From www.formsbank.com

Form Wv/cst220 West Virginia Use Tax Return printable pdf download West Virginia Sales And Use Tax Form — instructions for west virginia sales and use tax return, form wv. English deutsch français español português italiano român. Any individual or business that has made retail sales in west virginia or owes use. — west virginia levies a 6% state sales tax on the retail sale, lease, rental, or license to use tangible personal property and certain. West Virginia Sales And Use Tax Form.

From www.signnow.com

West Virginia Sales Use 20182024 Form Fill Out and Sign Printable West Virginia Sales And Use Tax Form Please attach all schedules and supporting documentation. — instructions for west virginia sales and use tax return, form wv. west virginia sales and use tax return. Any individual or business that has made retail sales in west virginia or owes use. — west virginia levies a 6% state sales tax on the retail sale, lease, rental, or. West Virginia Sales And Use Tax Form.

From www.formsbank.com

Form Wv/cst220 West Virginia Use Tax Return printable pdf download West Virginia Sales And Use Tax Form west virginia sales and use tax return. — west virginia levies a 6% state sales tax on the retail sale, lease, rental, or license to use tangible personal property and certain services in. — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. Please. West Virginia Sales And Use Tax Form.

From www.signnow.com

Va Sales Tax Form Fill Out and Sign Printable PDF Template airSlate West Virginia Sales And Use Tax Form — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. Please attach all schedules and supporting documentation. — this blog gives detailed instructions on how to file and pay sales tax in west virginia using the form called the combined sales and use return. . West Virginia Sales And Use Tax Form.

From www.formsbank.com

Instructions West Virginia Sales & Use Tax Return (Wv/cst200cu West Virginia Sales And Use Tax Form west virginia sales and use tax return. — this blog gives detailed instructions on how to file and pay sales tax in west virginia using the form called the combined sales and use return. — instructions for west virginia sales and use tax return, form wv. Any individual or business that has made retail sales in west. West Virginia Sales And Use Tax Form.

From www.formsbank.com

West Virginia Purchaser'S Use Tax printable pdf download West Virginia Sales And Use Tax Form — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. Please attach all schedules and supporting documentation. English deutsch français español português italiano român. — instructions for west virginia sales and use tax return, form wv. Any individual or business that has made retail sales. West Virginia Sales And Use Tax Form.

From www.formsbank.com

Form Wv/cst200 West Virginia Consumer'S Sales And Service Tax Return West Virginia Sales And Use Tax Form Any individual or business that has made retail sales in west virginia or owes use. — instructions for west virginia sales and use tax return, form wv. — this blog gives detailed instructions on how to file and pay sales tax in west virginia using the form called the combined sales and use return. — west virginia. West Virginia Sales And Use Tax Form.

From www.templateroller.com

Form WV/CST200CU Fill Out, Sign Online and Download Printable PDF West Virginia Sales And Use Tax Form — instructions for west virginia sales and use tax return, form wv. — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. Any individual or business that has made retail sales in west virginia or owes use. English deutsch français español português italiano român. . West Virginia Sales And Use Tax Form.

From www.templateroller.com

Download Instructions for Form WV/CST200CU West Virginia Sales & Use West Virginia Sales And Use Tax Form — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. English deutsch français español português italiano român. west virginia sales and use tax return. — west virginia levies a 6% state sales tax on the retail sale, lease, rental, or license to use tangible. West Virginia Sales And Use Tax Form.

From formspal.com

Cst 200Cu Form ≡ Fill Out Printable PDF Forms Online West Virginia Sales And Use Tax Form — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. — instructions for west virginia sales and use tax return, form wv. — this blog gives detailed instructions on how to file and pay sales tax in west virginia using the form called the. West Virginia Sales And Use Tax Form.

From www.formsbank.com

Form WvCst240 West Virginia State Tax Department Claim For Refund West Virginia Sales And Use Tax Form — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. west virginia sales and use tax return. — instructions for west virginia sales and use tax return, form wv. Please attach all schedules and supporting documentation. English deutsch français español português italiano român. . West Virginia Sales And Use Tax Form.

From www.formsbank.com

Form Wv/cst200 West Virginia Consumer'S Sales And Service Tax Return West Virginia Sales And Use Tax Form — instructions for west virginia sales and use tax return, form wv. Any individual or business that has made retail sales in west virginia or owes use. — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. — west virginia levies a 6% state. West Virginia Sales And Use Tax Form.

From www.signnow.com

Wv Sales Listing Form Complete with ease airSlate SignNow West Virginia Sales And Use Tax Form Any individual or business that has made retail sales in west virginia or owes use. — instructions for west virginia sales and use tax return, form wv. — this blog gives detailed instructions on how to file and pay sales tax in west virginia using the form called the combined sales and use return. Please attach all schedules. West Virginia Sales And Use Tax Form.

From studylib.net

Sales and Use Tax Return Form West Virginia Sales And Use Tax Form — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. English deutsch français español português italiano român. — west virginia levies a 6% state sales tax on the retail sale, lease, rental, or license to use tangible personal property and certain services in. —. West Virginia Sales And Use Tax Form.

From www.formsbank.com

Form Cst200cu West Virginia Sales & Use Tax Return Instructions West Virginia Sales And Use Tax Form English deutsch français español português italiano român. Please attach all schedules and supporting documentation. — this blog gives detailed instructions on how to file and pay sales tax in west virginia using the form called the combined sales and use return. Any individual or business that has made retail sales in west virginia or owes use. — west. West Virginia Sales And Use Tax Form.

From printableformsfree.com

Printable Wv Tax Forms Printable Forms Free Online West Virginia Sales And Use Tax Form — instructions for west virginia sales and use tax return, form wv. English deutsch français español português italiano român. — use tax is imposed on the use of goods and service in west virginia on which applicable sales tax has not been. west virginia sales and use tax return. Any individual or business that has made retail. West Virginia Sales And Use Tax Form.